Is your business ready to embrace the convenience and security of contactless payments? With Tap to Pay on iPhone, you can easily accept in-person transactions without the hassle of extra terminals or hardware. In this article, we’ll explore how Tap-to-Pay on iPhone can benefit your business and ensure user protection while complying with PCI standards.

What is Tap to Pay on iPhone?

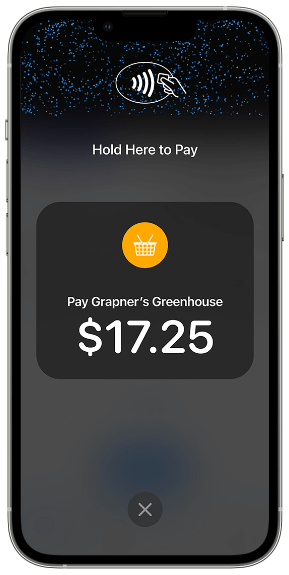

Tap to Pay on iPhone allows merchants to accept various forms of payment directly on an iPhone. Whether it’s a physical debit or credit card, Apple Pay, or other digital wallets, you can securely process contactless payments with ease. It’s a hassle-free solution that promotes user privacy and safeguards your customers’ financial information.

Tap to Pay on iPhone allows merchants to accept various forms of payment directly on an iPhone. Whether it’s a physical debit or credit card, Apple Pay, or other digital wallets, you can securely process contactless payments with ease. It’s a hassle-free solution that promotes user privacy and safeguards your customers’ financial information.

Securing Contactless Payment Cards When accepting contactless debit and credit cards, it’s important to verify their compatibility. Look for the EMV® Contactless Indicator on either the back or the front of the card. To process the payment, simply present your iPhone to the customer and ask them to hold their card horizontally on the designated tap area for a few seconds. It’s as simple as that!

Accepting Apple Pay With Tap to Pay on iPhone, you can seamlessly accept Apple Pay transactions. To proceed, present your iPhone to the customer and ask them to hold their iPhone near the tap area until the payment is complete. This effortless process enhances the customer experience and keeps your business at the forefront of modern payment methods.

Embrace Apple Pay on Apple Watch If your customers prefer using their Apple Watch for transactions, Tap to Pay on iPhone supports Apple Pay on Apple Watch too. Present your iPhone to the customer and instruct them to hold their Apple Watch near the designated tap area. This feature showcases your commitment to providing diverse payment options and accommodating various customer preferences.

Supporting Other Digital Wallets and Wearables Tap to Pay on iPhone extends its compatibility beyond Apple Pay. You can also accept payments from other digital wallets and wearables that facilitate contactless transactions. Simply ask your customers to hold their paying device near the tap area on your iPhone, and the payment will be securely processed. This flexibility ensures that your small business stays ahead of the curve, adapting to evolving payment trends.

Enhanced Security with PIN Entry As an added layer of security, Tap to Pay on iPhone, starting with iOS 16, supports contactless payments that require customers to enter a PIN. This feature provides peace of mind for both you and your customers, reducing the risk of fraudulent transactions. The PIN entry screen is customized by your payment service provider and automatically enabled by the customer’s card, ensuring a seamless payment experience. There are many other new features coming out on iOS 17 as well, Orinoco 360 can guide you with this amazing implementation.

With Tap to Pay on iPhone, you can accommodate individuals with different needs. By tapping “Accessibility Options” on the PIN screen, you can enable an accessible PIN entry mode. This mode utilizes the iPhone’s speaker to audibly guide customers through the payment process, while on-screen instructions assist you as the merchant. It’s a simple way to create an inclusive environment for all.

Partner with Orinoco 360 for Apple Support, we specialize in providing businesses like yours with top-notch cybersecurity risk management and reliable IT services. We understand the challenges you face, and our expert team is here to help you overcome them.

Whether you need assistance setting up Tap to Pay on iPhone, ensuring PCI compliance, or leveraging Apple support services, the team at Orinoco 360 got you covered. Fill out the form below to get in touch with any of our IT consultants and let us guide you through any IT hurdles your business may encounter. We look forward to helping your business thrive in the digital era.

To read more about Apple Tap-to-Pay for Business visit the Apple article page.